Key Takeaways:

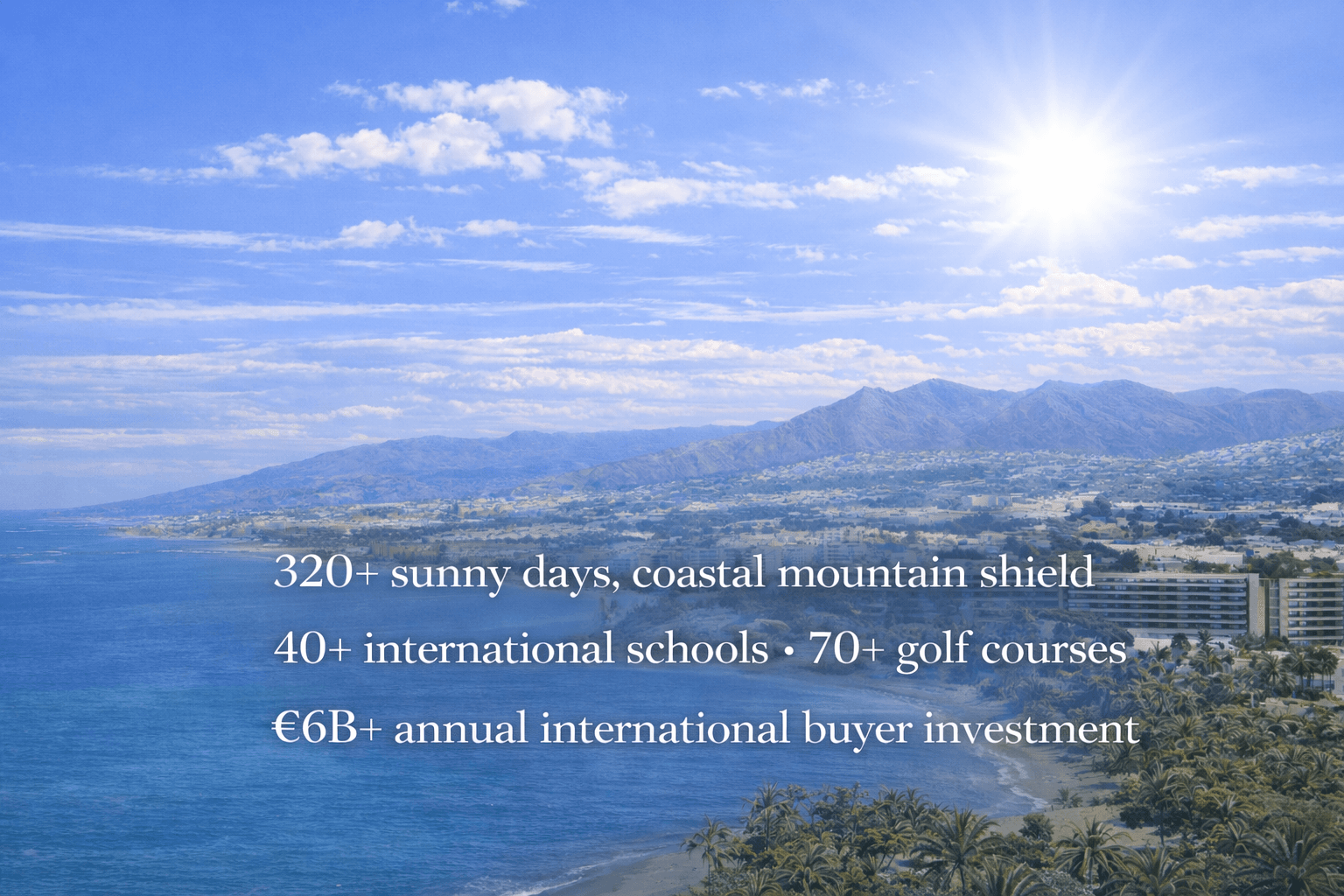

Structural Fundamentals: A year-round 12-month ecosystem featuring a unique microclimate with 320+ sunny days protected by a coastal mountain shield, high-density international schooling (40+ schools), over 70 golf courses, and world-class healthcare.

Optimized Rental Strategy: Focus on mid-term rentals (2–11 months) to achieve 3% net yield after all costs and taxes (5.5–6% gross) while maintaining high regulatory safety and personal use flexibility.

Capital Growth & ROI: Base case projected appreciation of +33.8% over 5 years. Leveraged purchases (70% LTV, interest starting from 2.5%) target a cumulative net ROI of ~70–80% (pre-exit costs).

Market Resilience & Security: A low-volatility market supported by a 50–60% cash-buyer ratio and highly diversified international demand from over 20 nationalities.

PART 1: WHY COSTA DEL SOL

Costa del Sol has evolved into one of Europe's most resilient, liquid and attractive residential real estate markets. It is no longer a simple holiday region. Over the past six decades, it has become a full-scale lifestyle and investment ecosystem, combining political stability, a unique microclimate, world-class infrastructure, diversified international demand and year-round livability.

Few coastal regions worldwide — and none in continental Europe — offer such a concentration of climate, accessibility, premium services, buyer diversity and long-term resilience.

1.1. Geography, Microclimate & Natural Structure

Costa del Sol stretches along approximately 160 km of Mediterranean coastline, from Sotogrande in the west to Nerja in the east. The coastline is framed by a continuous mountain system — Sierra Blanca, Sierra de las Nieves, Sierra Bermeja and the Alpujarras foothills — creating a natural climatic shield.

This topography generates one of Europe's mildest microclimates:

- Reduced wind exposure

- Stabilised temperatures

- 320+ sunny days per year

- Moderated humidity

- Cooler summers and warmer winters compared to neighbouring regions

The inland areas combine pine forests, natural parks, valleys and protected reserves. Together with several ongoing investments in desalination plants and water infrastructure, mitigating long-term water stress risks.

Important: This geography is also what limits large-scale urban expansion — a crucial driver of long-term price appreciation.

1.2. A Short Historical Context

Costa del Sol's international rise began in the 1960s, when Torremolinos became Spain's first global tourism destination, pioneering mass tourism in Southern Europe.

During the 1970s-1980s, Marbella and its Golden Mile established the region as a luxury hub, attracting international jet-set clientele and establishing Costa del Sol's reputation as one of Europe's premier lifestyle destinations.

Over the past two decades, the region has evolved beyond seasonal tourism into a year-round residential corridor—increasingly referred to as "Europe's California"—attracting families, remote professionals, entrepreneurs, and affluent relocators seeking climate, lifestyle, and stability.

1.3. Political Stability & Safety

Spain is a stable EU democracy with predictable regulations and low levels of social unrest. Unlike major European capitals that frequently experience political volatility or regulatory shocks, the Costa del Sol corridor remains low-tension, secure and lifestyle-driven.

This stability is one of the region's core investment advantages.

1.4. International Schools (40+ Across the Region)

Costa del Sol is home to over 40 international schools, an unusually high density for a Mediterranean coastal area.

These schools are concentrated in:

- Marbella East and West

- Benalmádena

- Estepona

- Mijas Costa

- Benahavís

- Sotogrande

Curricula include British, IB, German, Scandinavian and bilingual systems. This educational infrastructure is a major driver of long-term relocation and year-round residential demand from high-income families across the UK, Nordics, Benelux, France, Germany, Switzerland, Ireland, the US and Canada.

1.5. Healthcare Quality: Public + Private

The region combines a strong public system with a premium network of private hospitals, including: Costa del Sol University Hospital, Quirón Marbella, Hospiten Estepona, HC Marbella, Vithas/Xanit Benalmádena High-access, multilingual healthcare is a significant differentiator vs. other coastal or island destinations.

1.6. Lifestyle & Infrastructure Beyond Tourism

Costa del Sol's lifestyle appeal is rooted in permanent infrastructure, not temporary attractions.

Golf (70+ Courses)

The region hosts over 70 golf courses, the largest concentration in continental Europe, maintaining demand throughout the year — even during winter months when most coastal markets slow down.

Marinas

More than a dozen full-service marinas — including Puerto Banús, Sotogrande, Estepona, Casares/La Duquesa, Cabopino, Benalmádena and Marbella Marina — support nautical tourism, sports and luxury demand.

Wellness & Spa Resorts

Internationally recognised wellness assets include: Six Senses Spa (Puente Romano), Anantara Villa Padierna. Kempinski Estepona, Higuerón Nagomi Spa, Upcoming Lanserhof.

Gastronomy

Costa del Sol offers a consistently high-end gastronomic ecosystem, from Michelin selections to modern Mediterranean cuisine and vibrant international dining.

Warm-Winter Hiking & Nature

With Sierra Blanca, La Concha, the Sierra de las Nieves National Park (UNESCO Biosphere Reserve) and the Grazalema–Ronda system, Costa del Sol ranks among Europe's top warm-winter hiking destinations — a major advantage for year-round livability.

Winter Sports

Sierra Nevada, Europe's southernmost ski resort, is under 2 hours from Malaga — making Costa del Sol one of the few places in Europe where beach and skiing are possible on the same winter day.

Connectivity

- Málaga Airport is Spain's 4th largest, with direct flights across Europe and North America

- AVE high-speed rail connects Málaga to Madrid in 2h30 and to Córdoba or Sevilla in under 2h

- A-7/AP-7 coastal motorway and inland highways provide seamless road access across Andalusia and to the rest of Spain

Together, these elements make Costa del Sol a complete 12-month living ecosystem, not a holiday-only market.

1.7. International Demand (20+ Nationalities)

Costa del Sol attracts one of Europe's most diversified buyer pools, with strong demand from: Nordics, UK, Germany, Netherlands, Belgium, France, Switzerland, Ireland, Poland, US & Canada, Middle Eastern markets

No single nationality dominates. This diversification reduces volatility and supports long-term liquidity.

1.8. Buyer Motivations

Demand is structurally supported by:

- Mixed-use buyers combining personal use with rental income

- Second-home buyers seeking climate and stability

- Retirees from Northern Europe seeking quality of life and healthcare

- Relocators (entrepreneurs, remote workers, families)

- Digital nomads seeking long-term Mediterranean bases

- Luxury buyers (UHNW individuals seeking premium lifestyle assets)

- Investors seeking stable appreciation and risk-adjusted returns

This blend creates predictable absorption, even in soft macroeconomic cycles.

PART 2: TARGET RENTAL YIELD ANALYSIS

Understanding rental yields requires distinguishing between gross yields (rental income as % of purchase price) and net yields (after all buying and operating costs, management and marketing fees, and taxes). The figures below represent targeted net yields after all costs and taxes.

2.1. Long-Term Rental Yields (12+ months)

Net Yield: ~2-2.5% / gross 4-4.5%

Long-term rentals offer the most predictable, lowest-management option:

- Single tenant for 12+ months, that typically covers utilities

- Minimal management required. Lower wear and tear

- Protected by Spanish tenancy law (can be a disadvantage for flexibility)

Best for: Passive investors seeking stable, predictable income with minimal involvement.

2.2. Mid-Term Rental Yields (2–11 months)

Net Yield: ~3-3.5% / gross 5.5-6% (with effective property management solution)

Mid-term rentals target a high-quality, diverse tenant base seeking turnkey living solutions for 2–11 months.

The primary profiles include:

- Remote Workers & Digital Nomads: Location-independent professionals seeking lifestyle destinations with high connectivity.

- Seasonal Retirees ('Snowbirds'): Primarily Northern Europeans spending winter months (Oct–Mar) in the sun to avoid harsh climates.

- 'Rent-Before-Buy' Buyers: High-intent families or individuals trialing the area or awaiting property completion before finalizing a purchase.

- Corporate Relocations & Temporary Housing Seekers: Executives on fixed-term contracts or professionals needing interim upscale housing.

Key advantages:

- No tourist license required

- Strong winter demand from Northern Europeans (Oct–Mar) and very low supply for summers

- Flexibility to use property personally

Note: Requires effective marketing and quality property management.

Best for: Investors wanting better yields without short-term rental regulatory complexity.

2.3. Short-Term / Holiday Rental Yields

Net Yield: ~3-3.5% / gross 7.5-8% (with effective property management solution)

Short-term rentals (nightly/weekly) face increasing regulatory scrutiny:

- Requires touristic license that was drastically regulated since 2024, with bans or severe restrictions introduced in some municipalities like Malaga Center, Fuengirola, Manilva, and significant risk of losing even existing licenses

- Higher gross yields but significant operating costs: 15-25% platform fees (Airbnb, Booking), 20-25% property management costs, higher maintenance, cleaning, and turnover costs

- Seasonal volatility (high summer, low winter)

Best for: Investors with existing touristic licenses or properties in unrestricted zones.

2.4. Target Yield Comparison by Strategy

| Strategy | Net Yield | Gross Yield | Management | Regulatory Risk |

|---|---|---|---|---|

| Long-Term (12+ mo) | ~2-2.5% | ~4-4.5% | Low | Low |

| Mid-Term (2–11 mo) | ~3-3.5% | ~5.5-6% | Medium | Low |

| Short-Term (nightly) | ~3-3.5% | ~7.5-8.5% | High | High |

Key Insight: Mid-term rentals offer the best risk-adjusted yield — higher returns than long-term without the regulatory complexity of short-term. However, achieving 3-3.5% net requires a top property management company and careful contract negotiation.

PART 3: CAPITAL GROWTH SCENARIOS

3.1. Historical Performance (2015–2025)

As of 2026, the Costa del Sol real estate market is entering a phase of stable maturity, characterized by normalized interest rates (e.g., typically 2.5%–3.5%) and international demand that has proven to be structural rather than conjectural.

| Period | Annual Growth | Notes |

|---|---|---|

| 2015–2019 | 5–7% | Post-crisis recovery |

| 2020 | ~0% | COVID pause |

| 2021–2025 | ~10% average | Strong post-COVID demand |

Source: Official notarial transaction data, Registradores de España

3.2. Base Projections (2026–2030)

The recent 10% annual growth is unlikely to sustain indefinitely. Our projections reflect a normalisation to long-term sustainable levels.

| Scenario | Annual Growth | 5-Year Total | Assumptions |

|---|---|---|---|

| Conservative | 4% | +21.7% | Soft European slowdown, stable inflation, constrained supply |

| Base Case | 6% | +33.8% | Structural international demand continues, gradual rate normalisation |

| Bull | 8% | +46.9% | Strong global cycle, rate cuts, renewed international capital inflows |

It is crucial to view these projections against a backdrop of stabilized Eurozone inflation (forecasted in the 2–3% range for this cycle). In this context, the 6% Base Case nominal growth represents significant real asset appreciation, reinforcing premium real estate's role as an effective inflation hedge compared to cash or fixed-income alternatives.

Structural drivers include:

- Climate migration

- Remote work adoption

- High-quality infrastructure

- Real-asset inflation hedging

- Demand reallocation during periods of geopolitical or social uncertainty

These support continued international demand, while a gradual normalisation from post-COVID growth peaks is expected.

The projection framework reflects Costa del Sol's position as a structurally constrained, international lifestyle market, where downside scenarios are typically expressed through slower appreciation rather than prolonged nominal price declines.

Geographic constraints (coastal mountains) and strict urban planning in premium zones (Marbella, Benahavís, Sotogrande) structurally limit new supply, supporting long-term price resilience.

These scenarios reflect nominal price growth assumptions and do not incorporate leverage effects or rental income, which are analysed separately.

3.3. Leverage Effect on Returns

The following example illustrates a conservative-moderate growth case (4.5% per year), positioned between the Conservative and Base scenarios outlined above. Actual Base Case returns would be higher.

Key Insight: Yield contributes only 20–30% of total ROI. Appreciation + mortgage amortisation + leverage contribute 70–80%.

With 70% LTV financing (30% down payment), appreciation applies to the full property value while your capital at risk is only 30%. This creates a leverage multiplier of approximately 3.3x on appreciation returns.

Example (Base Case, €500,000 property):

- Down payment: €150,000 (30%) + taxes and buying costs (ITP/IVA, notary, and legal fees). Furniture and renovation costs for second homes are accounted for in the net yield calculations to ensure a turnkey investment model.

- Mortgage: €350,000 (70%) at 3.5% interest (current market offers for well-profiled buyers start at approximately 2.5%; the model assumes 3.5% to reflect fixed-rate financing, all-in borrowing costs and a conservative risk buffer)

- 5-year appreciation (4.5%/year conservative moderate scenario): €123,000 gain on full property

- Return on YOUR capital: €123,000 / €150,000 = 82% from appreciation alone

- Plus: rental income, principal amortisation

- Minus: interest payments, transaction costs

- Net ROI: ~70–80% over 5 years, or 11–12% annualised

Note on Returns: The projected ROI (70–80%) represents the gross return on capital before exit costs (sales commission, capital gains tax, and Plusvalía).

3.4. Cash Purchase vs. Leveraged (Conservative-moderate)

| Metric | Cash Purchase | 70% LTV |

|---|---|---|

| Capital at risk | €500,000 | €150,000 |

| 5Y appreciation gain | €123,000 | €123,000 |

| ROI on capital | ~24.6% | ~82% |

| Annualised ROI | ~4.5% | ~12.7% |

3.5. Impact of Rental Strategy (Conservative-moderate, Leveraged)

| Strategy | Net Yield | 5Y Rental Income | 5Y Net ROI |

|---|---|---|---|

| Long-Term | 2.5% | €62,500 | ~70–75% |

| Mid-Term | 3% | €75,000 | ~75–80% |

| Short-Term | 3% | €75,000 | ~75–80% |

Recommendation: Mid-term rental offers the best risk-adjusted returns — comparable yield to short-term without the regulatory risk and management complexity.

PART 4: RISK MITIGATIONS

After the 2008–2014 crisis, Costa del Sol structural improvements have increased resilience and provide better downside protection today.

| Factor | 2008 | Today |

|---|---|---|

| Buyer nationality concentration | 40–50% UK | 20+ nationalities, no dominant |

| Cash purchases | ~30% | 50–60% |

| Average LTV | 80–100% | 50–70% |

| Unsold inventory | Massive oversupply | Minimal, demand > supply |

| Remote work driver | Did not exist | Structural demand driver |

| Climate migration | Marginal | Accelerating trend |

4.1 Downside Protection Factors

Why Costa del Sol is more resilient than other markets:

- High cash buyer ratio (50–60%) — fewer forced sellers in downturns

- Diversified buyer base (20+ nationalities) — not dependent on single economy

- Structural undersupply — geographic constraints limit new construction

- Year-round demand — not purely seasonal like many coastal markets

- Established infrastructure — schools, healthcare, transport attract permanent residents

- Lifestyle fundamentals unchanged — climate, accessibility remain regardless of economic cycle

Premium segments (Golden Mile, Benahavís, prime beachside) tend to maintain transactional liquidity even during market corrections, typically through longer selling periods rather than aggressive price compression — unlike mass-market coastal areas, where price adjustments tend to be faster and deeper.

Regulatory Buyer Protection in New Developments

Spanish residential development is governed by a strict buyer-protection framework introduced and reinforced following the 2008–2014 real estate crisis.

Key protections:

- Advance payments are typically collected only after obtaining the full building permit

- All buyer deposits must be held in segregated special accounts (cuentas especiales)

- Buyers are legally entitled to individual bank guarantees or insurance policies covering all advance payments, ensuring full capital protection in the event of project non-completion

This framework significantly reduces construction and counterparty risk compared to many international markets. As a result, speculative off-plan activity is structurally constrained, supporting more sustainable pricing dynamics and reducing systemic risk across the market.

Anti-speculative Market Structure

Spain's robust anti-money laundering (AML) and source-of-funds regulations impose strict capital transparency requirements on residential transactions. These controls have limited speculative and opaque capital inflows, contributing to a more institutionally driven and end-user-oriented market.

Unlike markets characterised by rapid speculative cycles and low entry barriers, Costa del Sol has avoided boom–bust dynamics driven by short-term capital, reinforcing long-term price stability.

CONCLUSION

Costa del Sol stands as one of Europe's strongest residential real estate markets, offering:

- A premium 12-month lifestyle ecosystem

- Diversified global demand (20+ nationalities)

- Exceptional infrastructure (schools, healthcare, connectivity)

- Structurally constrained supply

- Strong historical appreciation (~10% average 2021–2025)

- Moderate but stable rental net yields (2.5–3% net)

- Superior downside protection with high cash purchases

Conservative Moderate Case Net ROI: ~70–80% over 5 years (11–12% annualised) with leveraged purchase and mid-term rental strategy.

For international buyers and investors, Costa del Sol represents a compelling combination of lifestyle quality and investment returns — one of the most compelling lifestyle-driven real estate markets in Europe for the 2026–2030 cycle.

IMPORTANT DISCLAIMERS

This analysis is for informational purposes only and does not constitute investment, financial, legal, or tax advice.

Past Performance: Historical data does not guarantee future results. Real estate markets are cyclical and subject to macroeconomic and regulatory factors.

Individual Variation: Property performance varies significantly by location, type, timing, and circumstances.

Data Currency: Information current as of Q1 2026 and subject to change.